Tumult in tech dominates headlines these days – from Silicon Valley layoffs to Elon Musk’s mayhem at Twitter -- but none matches the collapse of one of the world’s biggest cryptocurrency exchanges, FTX. Until November 17, it was a private offshore outfit run by a 30-year-old math genius, then it suddenly filed for bankruptcy after racking up liabilities of $50 billion or more. As many as one million investors are ruined but, more importantly, its failure has shattered the trillion-dollar digital currency world. It looks like skullduggery or recklessness, but the underlying problem is that crypto is an unregulated financial sector run amok – a situation yet to be addressed by most governments, with the exception of China. Cryptocurrencies, notably Bitcoin, proliferate to facilitate money laundering of criminal proceeds and, most recently, sanctions-busting by Russia. Famous economist Nouriel Roubini recently declared that the crypto market is an “ecosystem that is totally corrupt” and that its biggest players are “con men”.

FTX’s founder and owner was Sam Bankman-Fried, the son of American academics, who graduated from MIT in physics and math. He boasted that he was “worth” $28 billion just before the crash. He was celebrated as a superstar and even mused a few months ago about taking over Wall Street giant Goldman Sachs. Now following an expose written by a crypto publication, FTX has cratered and he and his team are under investigation for fiscal recklessness, incompetence, and possibly criminal offenses such as fraud and/or misappropriating customer funds to prop up the crypto empire.

Bankman-Fried has been replaced by a new “boss”, court-appointed CEO John J. Ray III, who also cleaned up the Enron mess in 2001. In his court filings, Ray declared that this one is more serious and that there was a “complete failure of corporate controls” culminating in this “unprecedented debacle.” He added that this was worse than anything he’s seen in 40 years of restructuring firms.

Unlike Enron, the FTX empire wasn’t a public company nor was it headquartered in the United States. It was based in The Bahamas and incorporated in Antigua, and was one of more than 100 companies in Bankman-Fried’s network of holdings. Its management team was controlled a small group of inexperienced and “potentially compromised” individuals, said Ray. And a substantial portion of the $50 billion in assets held in the FTX exchange may be “missing or stolen”.

Investigators will look into whether customer funds were misused, customer privacy was breached, and information was purposely concealed. One commentator said it resembles a latter-day version of Bernie Madoff’s Ponzi scheme -- where customer positions and transactions were fabricated. But the investigation has just begun and will be difficult. Transactions and operations were offshore, sophisticated software programs were deployed to execute and transfer funds, and its principals are not residents of the United States.

Unfortunately, FTX isn’t the only restructuring that’s required in the crypto world and its demise will hopefully speed up crypto regulations that have been stalled or shelved in most jurisdictions. Thousands of cryptocurrencies proliferate and, along with money laundering, tax evasion, and sanctions-busting, governments are concerned about their threat to the international financial system. In 2021, China led the world by recognizing this threat to its financial, taxation, and political systems, and acted. Beijing banned all cryptocurrencies, prohibited financial institutions from engaging in any transactions, stopped crypto mining which uses exorbitant amounts of electricity, and outlawed cryptocurrency possession.

China took this action to prevent financial crime but also to protect consumers and their assets from the fraud and risks involving in participating in unregulated markets. These currencies, or “coins” like Bitcoin, have no intrinsic value and are basically computer files with e-codes that can be stored in a “digital wallet” app on a smartphone or computer. They are only accessible via a torturously long passwords. Estimates are that 20 percent of Bitcoin that has been purchased and locked away is inaccessible to owners because they forgot their keys. These lapses total tens of billions of dollars.

FTX is just one of many questionable exchanges or “funds” promoting this stuff, many of which are not legit. Crypto is used by criminals to receive secret payments which are then swapped for bona fide currencies and invested in assets, also hidden in secrecy havens or used to buy illicit goods and services. Bitcoin and the others are only worth what the last guy paid for them. They don’t create jobs or products or innovation or economic wealth nor do they protect people from currency debasement. They are mostly greed with a bar code.

Crypto is becoming a global scourge. Bitcoin began in 2009 and thousands more versions have been spawned. For instance, Bitcoin is now the legal currency of narco-state El Salvador and kleptocratic Central African Republic, which has been overrun by Russian-backed mercenaries. In April, the International Monetary Fund warned that the jump in cryptocurrency trading in emerging markets – since the pandemic and during the Russian war -- imperils the global financial system. It noted that trading volumes of crypto assets against some emerging market currencies have spiked and they are used to purchase sanctioned goods, commodities, and services from Russia.

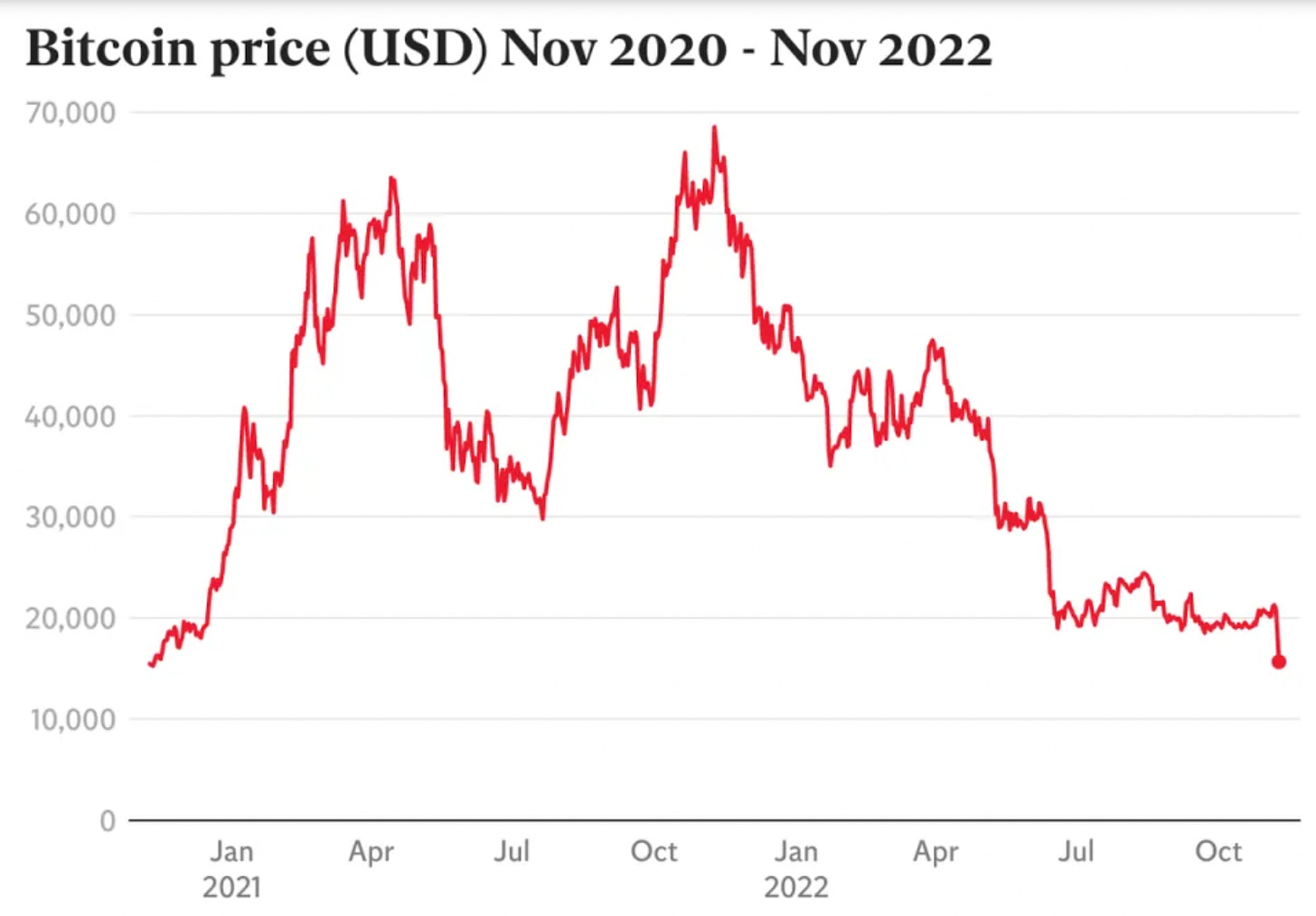

Since FTX went bust, roughly $200 billion has been wiped from the global crypto market. Bitcoin‘s market value is down calamitously and J.P. Morgan believes this is the start of a cascade of catastrophic price drops. This has led the head of FTX competitor, Binance, to warned investors to “stay away” for awhile, and Bitcoin fan, Elon Musk, says that Bitcoin “will make it” but only after a “long winter”. He added that crypto Dogecoin, which he’s promoted, will be fine. (In June, Musk was sued for $258 billion by a Dogecoin investor who accused him of running a pyramid scheme to support the cryptocurrency.)

One crypto fan wrote off this quagmire by describing it simply as a clash of competing geeks. But the IMF says otherwise and governments scramble to regulate because this is the tip of a very dangerous iceberg heading toward the global economy.

Diane you have written a very good crypto piece, well researched. I like your basis - Greed - because all cryptos are fake (except Bitcoin which has a store of value in 29 million coins). Sure, they have stored value (cash) but it apparently isn't enough to withstand a Run (Biance). And how much would Bitcoins be really worth if those electronic pieces were liquidated?

Very interesting . Even more interesting and inexplicable is how the Ontario Teachers Pension Fund was allowed to, and did invest 95 million dollars of pension funds into the FX fund because it wanted to be perceived as “forward looking” in its investment policy . This was hard on the heels of the multi million dollar CPP investment into the failing retailer Nieman Marcus, moments before the latter filed for bankruptcy. One wonders if the Canadian governments are getting the message at any level . All pension moneys lost due to repeated recklessness and negligence ; when you put a clown in office , the kingdom becomes a circus.