New York and Miami skylines have been built with lots of dirty money derived from crime and kleptocracy. Since this came to light, U.S. Treasury officials have targeted popular investment destinations and required condo developers to disclose the names of the beneficial owners of real estate who hide behind layers of anonymous corporations, trusts, foundations, or proxies. The United States and other G7 nations are preferred money laundering destinations for these crooks because, ironically, these countries have the rule of law. This means that their mansions and yachts are safe from the kind of confiscation and theft they have gotten away with back home.

Fraudsters, despots, tax evaders, and drug lords have been snapping up expensive and luxurious properties in the world’s most desirable locations. They also game visa and immigration programs to ensconce their children in America or elsewhere. Their offspring mop up private school and university positions and the parents defraud immigrant investor funds to wash illicit funds, hobnob with notables and real estate magnets to spread their influence, bribe and co-opt politicians wherever possible, and never pay their fair share of taxes at home or abroad. These people are a scourge and are enabled by a host of real estate professionals, and lawyers, and real estate corporations across the G7, to get away with it. Former President Donald Trump cashed in on this bonanza as a condo developer and casino owner.

In August, a sweeping report called “Acres of Money Laundering” underscores America’s failure (and the other G7 countries) to halt this growing problem. It also explains how enablers shoehorn funds into the United States and other countries by exploiting loopholes, visa programs, or by simply taking advantage of the fact that lawyers and real estate professionals are not regulated or supervised and secrecy laws protect the bad guys from being apprehended.

“Acres” was published by Global Financial Integrity (GFI) in Washington DC -- the world’s foremost think tank on illicit financial flows, corruption, illicit trade, and money laundering. It examined a few hundred known criminal cases in all G7 countries and explains the amounts involved, how this is accomplished, and what can be done to stop the flow. The United States portion of the report analyzes 56 cases over five years, involving $2.315 billion, and is just the tip of the iceberg. In 2020, GFI estimated that the scale of money laundering through the U.S. economy ranged between $418.6 billion and $1.046 trillion, according to law enforcement officials.

In the U.S., 82.14 percent of the cases involving foreign dirty money from Mexico, Guatemala, and Venezuela followed by Iran, China, and North Korea. The rest was from domestic sources. In the United Kingdom, some 73.6 percent of the dirty money came from India, Pakistan, Azerbaijan, Russia, Ukraine, Kyrgyzstan, and Kazakhstan, and the rest domestic sources. In Canada, some 51.5 percent of the dirty money came from the United States, China, and the Republic of the Congo. Nearly half came from domestic sources, likely drug trafficking.

In 2021, the United Nations estimated that between two percent and five percent of the world's GDP is laundered – between $800 billion and $2 trillion a year. Much of this is done through real estate, fine art, over and under-invoicing trade transactions, or cryptocurrencies.

The only watchdog over this is the United Nations’ Financial Action Task Force (FATF) which audits countries and publishes recommendations to reform or tighten systems. These are mostly ignored. For instance, FATF has recommended that jurisdictions require lawyers, real estate professionals, mortgage brokers, or notaries to alert authorities about suspicious buyers, lenders, borrowers, or transactions. This is what banks have been required to do for years, which is why suitcases full of cash are no longer shoveled into bank accounts anymore, except in rare instances.

The 56 American cases mostly involved residential purchases, 91 percent, and the rest was a mixed bag of commercial properties like hotels, office parks, factories, supermarkets, and solar or wind farms. The examples also demonstrate that law enforcement authorities in the G7 aren’t sharing information to the extent they should in order to catch these culprits.

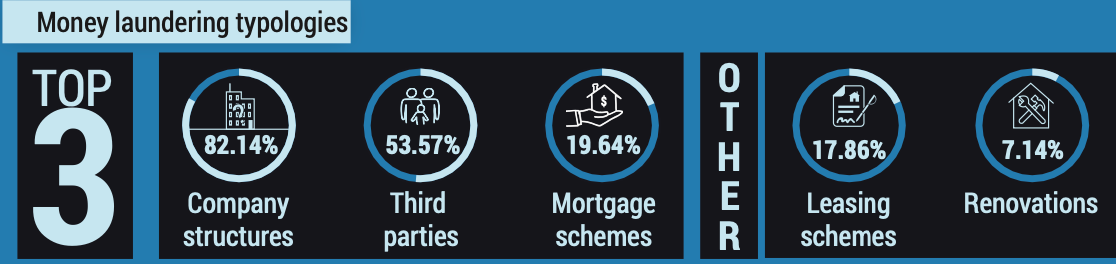

The use of anonymous shell companies and complex corporate structures continues to be the number one money laundering typology. Eighty-two percent of U.S. cases involved the use of a legal entity to mask ownership, highlighting the need for governments to outlaw anonymous corporations, remove secrecy laws, and force disclosure by requiring robust beneficial ownership registries.

America’s EB-5 visa investor programs have been abused along with immigrant investor funds. Techniques used in real estate laundering include leasebacks, loan-back schemes, third-party purchases involving accomplices, under and over-valuation, cash purchases, use of real estate investment funds, corporate shells, trusts, and offshore banks in secrecy havens.

The lack of collaboration among national law enforcement agencies is a problem because this is, by definition, about trans-border criminality. “One egregious example involved the embezzlement of US$100 million from Kuwait’s Department of Defense that was used to purchase an entire ‘mountain’ in Beverly Hills (a 157-acre property), with no questions asked about the financing,” it wrote.

Another case cited involved Paul Manafort, Trump’s campaign chair and an all-around sleazebag who worked for kleptocrats in Eastern Europe and Africa. The report described his techniques: “Paul Manafort laundered money he made while advising a pro-Russian regime in Ukraine, by buying and renovating properties in the Brooklyn and Manhattan boroughs of New York City, the Hamptons, and Arlington (VA). According to the Department of Justice, Manafort used his offshore accounts (mostly) in Cyprus to purchase U.S. real estate and spend millions on home improvements on his property in the Hamptons.”

“To make the purchase, Manafort funneled money through a web of shell companies and subsequently used these properties as collateral to obtain loans from financial institutions. For example, after the US$2.85 million all-cash purchase of a condo in Manhattan through a shell company, Manafort transferred the unit into his own name and then borrowed money against it with a value exceeding the home value. To obtain the US$3.4 million loan, Manafort falsely told the bank that the property was a second home for his daughter when in reality he rented it out on Airbnb. Additionally, he caused an insurance broker to provide false information to the bank through an outdated insurance report, thereby hiding the previous mortgages on the property. A New Jersey-based real estate attorney has been associated with the legal entities used to purchase real estate, signing for biennial statements and loans.”

Other culprits are real estate professionals, such as mortgage brokers and real estate agents, followed by lawyers. In the UK, laws now require that lawyers report suspicious transactions and clients, but this has been fought vigorously in the U.S. and Canada where the profession insists such a requirement would breach the right to “client confidentiality” that they must uphold. This represents the single biggest major obstacle to detection and enforcement, along with the fact that trust fund accounts by lawyers or their firms have also been used as conduits for illicit funds to be transferred into property ownership.

Letting lawyers off the hook is a mistake because they are at the heart of most schemes and transactions. They set up the structures — anonymous companies, real estate funds, trusts, or offshore vehicles to hide their clients’ identities — then hide behind client confidentiality.

Another example involved former President Donald Trump’s company. “Between 1999 and 2012, more than 1,300 apartments branded by the Trump Organization were sold for a total of US$1.5 billion in suspicious all-cash transactions with anonymous shell companies based in Delaware, as well as secretive jurisdictions such as Panama, Cayman Islands, and the British Virgin Islands,” according to GIF’s report.

“In the Trump SoHo hotel, more than half of these secretive sales were facilitated by one Manhattan-based real estate lawyer. He signed the deeds of transfer, created shell companies, and registered his Manhattan office address and his own name as agent for these entities. Some apartments were sold to politically exposed persons, such as former Haitian dictator Duvalier,” according to GIF.

These high-profile cases resulted in the passage of the Corporate Transparency Act in Washington in 2020. It requires the creation of a beneficial ownership registry. The UK has set up such a system, but information submitted is not verified and criminals have posted fictitious information, said the report. Britain’s registry also does not include ownership behind trusts. But France has the best registry, states GIF, and serves as a model for the other G7 countries.

Canada is a laggard and the massive amount of real estate money laundering in Vancouver and Toronto has pushed up prices, making housing unaffordable for its middle classes. The scale is so massive that the global term “snow washing” has been coined to describe how easily dirty money can be washed clean, like the snow, in Canadian real estate.

The issue of illicit capital flows isn’t simply about crime or the wholesale rape of the world’s developing nations by dictators, cartels, and crooks. It’s also about national security and the health of the world’s financial system where trillions are hidden offshore untaxed. That is why a crackdown on money laundering, in all its guises, is critical and represents a battle for civilization itself.

My newsletters will arrive in your inbox Monday and Thursday mornings.

IMPORTANT: When you sign up please add dianefrancis@substack.com to your contact list or the newsletter will be blocked by your spam function.

As usual we see that money talks and s**t walks. Great article as usual but unless and until a solid legislative body actually does something about these issues, the problem won’t go away.

Excellent article. A convicted drug dealer bought an Edmonton Apartment and boasts he is a big shot worth 30 m who will crush any neighbour who stands in his way! I had to call 911 multiple times!!