Wars rage all over the map, but the one that could theoretically cause the most significant damage globally is President Donald Trump’s assault against Jerome H. Powell, chair of the Federal Reserve. He has taken him to task for resisting his demands to lower interest rates, publicly mused about firing him, and repeatedly described him as “stupid.” Fortunately, the United States is not a banana republic whose leaders can order the printing presses to push out more paper so they can overspend and be re-elected. Even so, these personal attacks are unprecedented and worrisome to some market players because the world relies on the independence of the Federal Reserve Board and its Chairman as custodians of the US dollar. In recent weeks, Asians and others have been cashing in dollars, and market experts hope the Fed remains resolute. “Powell shouldn’t be pushed into rate cuts,” wrote William Pesek, an investment and economics commentator with Japan’s Asia Times. “The Fed is also a key protector of nearly US$3 trillion of Asian savings parked in US Treasury securities.”

And Asia’s money talks. On April 9, the day after Trump announced his draconian global tariff scheme, the regular, global 10-year US bond market auction failed. US Treasury Secretary Scott Bessent understood the danger, panicked, and rang the fire alarm in the White House, which led to Trump’s 90-day pause on reciprocal tariffs. That prevented a financial massacre, signaled by Asian interests dumping trillions in bonds. Today, that same vigilance prevails as Trump’s tantrum toward his central banker rattles the very basis of world economic stability, the American dollar. “As Trump tries without success to reduce the Fed’s independence, the world of trade would also be damaged. Asia’s export-driven economies would be hit hard by a surge in US yields or by a sharp drop in the dollar as investors cut their losses and flee,” warned Pesek.

The US dollar is now considered “unattractive,” and further declines are expected as the US economy loses momentum and Washington’s deficits continue to spiral out of control. Fortunately, Fed Chairman Powell has remained poised, and Congress remains fully supportive -- despite a shower of abuse from Trump and his Vice President. In congressional testimony this week, Powell “did his best to pretend all’s well between Trump World and the Fed”, noted one financial commentator. But many are concerned that Trump may escalate his conflict with the Fed Chair. He cannot force him to resign before his term ends in May 2026, or fire him, but some speculate that he may announce a replacement this fall for Powell’s position. The Wall Street Journal quoted analysts who said that person would operate as a “shadow” Fed Chair, undermining his influence and, along with it, the Greenback’s value.

“The dollar has fallen 10 per cent against most currencies this year,” wrote The Financial Times, speculating that Trump’s strategy all along has been to lower interest rates, but also to reduce the Greenback’s value. “A weak dollar was known to be part of Trump’s policy, despite this being unusual for a right-winger and despite it making Americans poorer in euro, yen, or renminbi terms. Improving export competitiveness was seen as more important.” While a lower dollar may provide a temporary competitive advantage in trade, it represents a red flag to America’s creditors who finance the Pentagon and Washington’s profligacy. Recently, credit agencies downgraded the US sovereign debt rating slightly, which increased Washington’s borrowing costs.

Besides the spat, there are many other reasons for its fall. The US dollar still dominates, but disaffected investors are investing in “nontraditional reserve currencies” such as gold and other non-Euro currencies, according to Wolf Richter, publisher of Wolf Street. He cited IMF data that the US dollar represents 60% and the Euro 20% of total currency holdings. However, increases have occurred in the top nontraditional reserve currencies: the Japanese yen (5.8%), British pound (4.7%), Canadian dollar (2.8%), Chinese renminbi (2.2%), Australian dollar (2.1%), and Swiss franc (0.2%). Another 4.6% is spread among a basket of other foreign currency reserves.

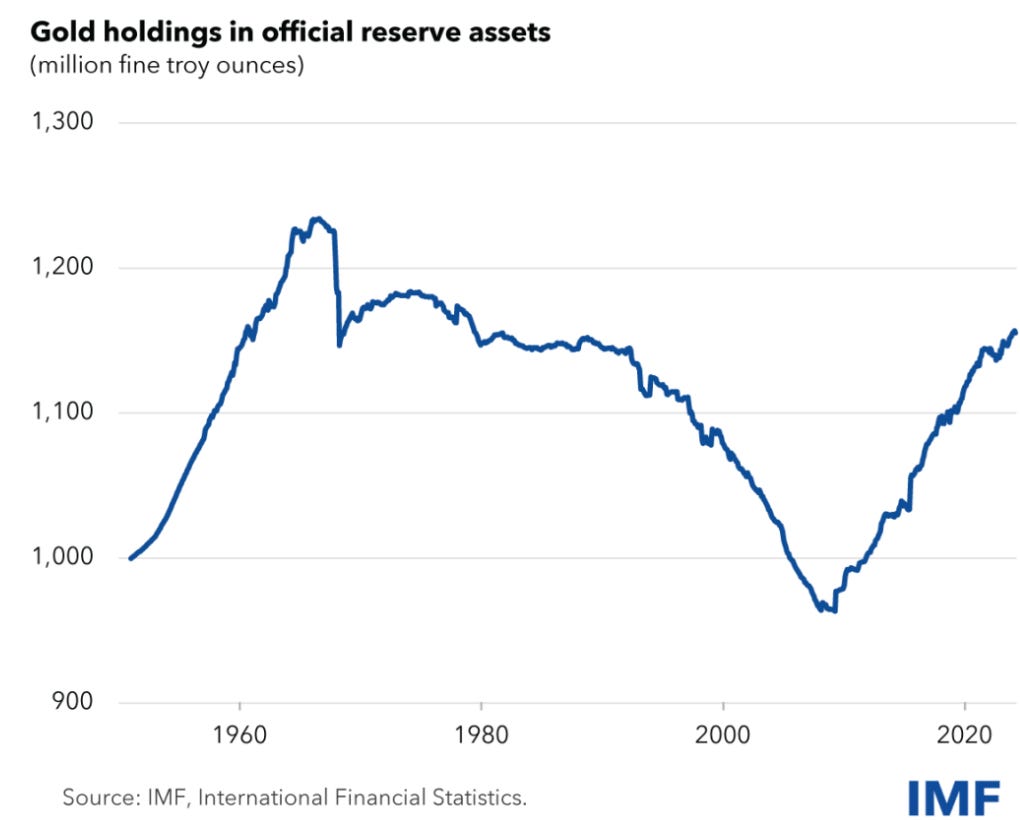

But gold is by far the biggest beneficiary as a result of the US Dollar’s decline, as this chart illustrates:

Gold’s Ongoing Geopolitical Story

After forty years of decreasing their gold holdings, central banks began rebuilding their bullion reserves around 20 years ago. Richter noted that the top four central banks by gold reserves— the US (8,133 tonnes), Germany (3,352 tonnes), Italy (2,452 tonnes), and France (2,437 tonnes) — have not changed their holdings in at least 20 years. However, there has been significant movement below the top four, particularly with Russia and China, which are now the fifth- and sixth-largest holders. Combined, Russia and China have added 3,626 tonnes to their holdings since 2005, he noted, and smaller holders, such as Poland, India, Kyrgyzstan, and Uzbekistan, also added substantial amounts of gold last year.

“According to the IMF figures not updated for 2024, central banks’ gold holdings have surged by roughly 200 million troy ounces (6,221 tonnes) from 2006 to 1.16 billion troy ounces, driven largely by China and Russia,” Richter wrote. “The increases in China and Russia alone represent nearly 60% of the total increase since 2006. In dollar terms, gold holdings total US$3.65 trillion.”

Falling dollar prices and Trump’s war against the Fed led Germany and Italy to decide to move their gold from New York. This decision was made due to repeated attacks on the US Federal Reserve and the increasing geopolitical turbulence, according to the Financial Times. Both countries hold the world’s second and third-largest national gold reserves after the US, with reserves of 3,352 tonnes and 2,452 tonnes, respectively, according to World Gold Council data. Both relied on the New York Federal Reserve in Manhattan as a custodian for decades, with each storing more than a third of their bullion there, valued at $245 billion. Traditionally, New York and London are the world’s most important trading hubs for gold. Even so, Trump’s erratic policymaking led to public demands in these two European countries for their bullion to be repatriated.

While eyebrow-raising, there’s no reason to panic or worry about a global meltdown, says economist Nouriel “Dr Doom” Roubini, who believes the US dollar’s status as an international reserve currency has merely been “dented”, and a dramatic decline is not in the cards. Trump’s tiff with the Fed is a factor, and his yo-yoing about anything is another concern. Still, Roubini and others attribute the dollar’s weakness to growing government deficits, a slowing economy, and an increase in investor interest in alternative currencies, digital payment systems, and gold. Besides, there are no other contenders to replace the Greenback as a “haven” and the global trade currency. While Trump’s baiting is unhelpful, there is no way to unseat Chairman Powell and his board of governors. Besides, as former US Treasury Secretary Lawrence Summers quipped, there is no replacement for the US: “Europe is a museum, Japan is a nursing home, and China is a jail,” he said.

NOTE TO READERS: Please consider supporting my writing by subscribing to my Substack. A paid subscription grants access to all of my articles year-round.

Love Trump calling Howell stupid. Trump might look at himself. Not only stupid but a felon, breaks the Constitution daily, loves a fascist leader in Russia and hates Zelenski a great leader and humble man. Look at what the idiot is doing to Canada. Then we can remember American electorate put him there twice . Stupid?

A superb article Diane.

Excellent very interesting thank you,