Warren Buffett’s Berkshire Hathaway has more cash in the bank than any other American company, a staggering $334 billion, as a result of selling half its stock market portfolio in the past few months because Buffett felt prices were too high. Then along came President Donald Trump’s “Liberation Day” on April 4, which introduced draconian tariffs and urged leaders to negotiate and lower their tariffs on the United States. Buffett had warned in March against tariffs “because they are an act of war” and they increase inflation. But Trump proceeded, pulling the pin on the global trading system and stock markets. He also claimed Buffett endorsed tariffs, which was untrue and flatly denied. Now markets plunge, and many fear a recession, or worse. Even Trump supporters in Silicon Valley and on Wall Street are upset and tried this week to convince the President to halt tariffs and stop stock market losses. But Trump remained defiant. When asked on Air Force One about falling prices, Trump said, “crashing markets? I want to solve the deficit problem in trade. You have to take medicine to fix something.”

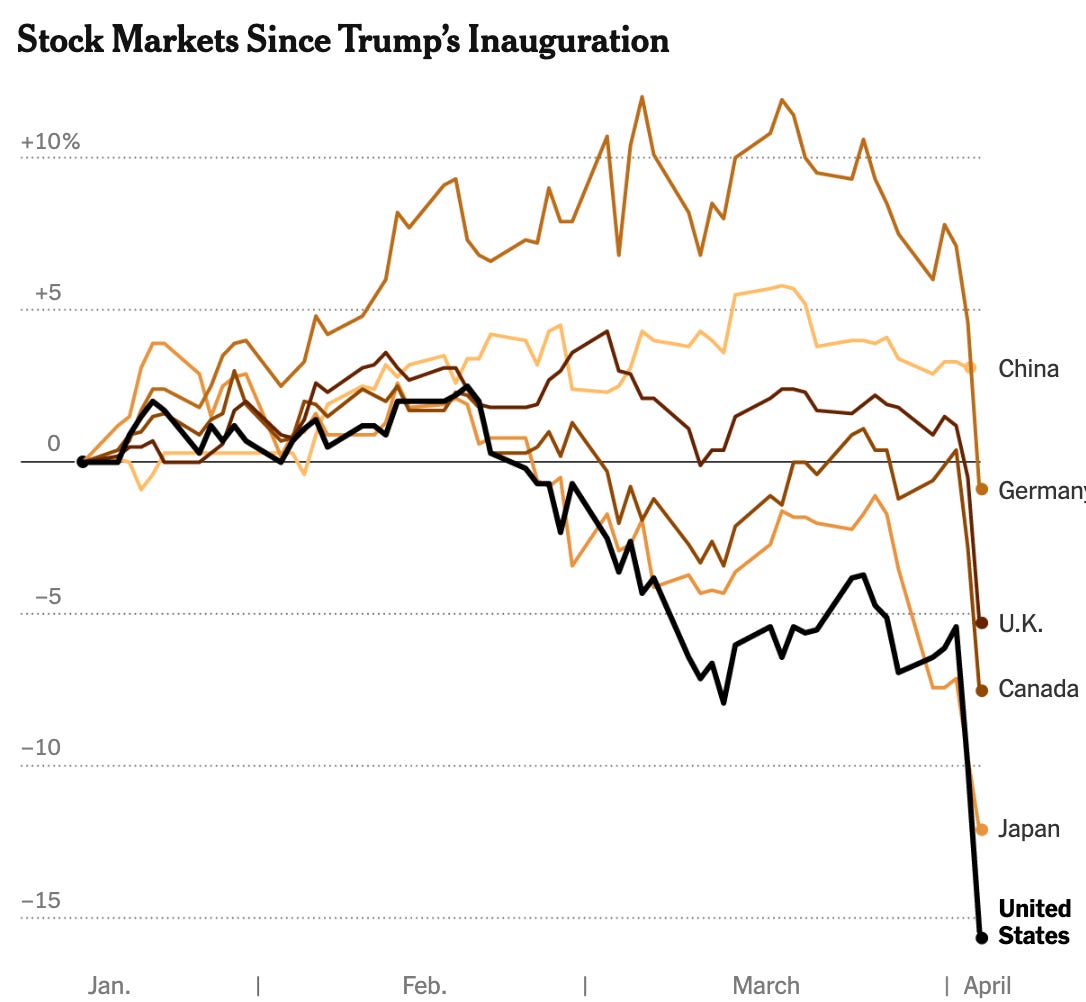

By April 7, stock market prices had lost all the previous year’s gains. Americans with a 401(k), brokers, and entrepreneurs have lost $6.6 trillion on paper. The plummet caused Trump billionaire supporter Bill Ackman to publicly state late on April 6, as Asian markets crashed, that the President was losing the confidence of business leaders and should pause his trade war. “The President has an opportunity to call a 90-day timeout to resolve trade issues via negotiation. If, on the other hand ... we launch economic nuclear war on every country in the world, business investment will grind to a halt, consumers will close their wallets and pocket books, and we will severely damage our reputation with the rest of the world that will take years and potentially decades to rehabilitate.”

Others question whether Trump’s tariff strategy, designed to repatriate jobs and factories, will work. His scheme is to strong-arm nations with trade surpluses to drop their tariffs and to convince manufacturers to move, or return, their operations to the US to revitalize America’s manufacturing base and living standards. But the scheme is flawed: America’s “rustbelt” won’t prosper again because, ironically, Trump’s policy and personality sabotage the goal. Few nations or companies will invest billions in the United States where an erratic President declares injustice that doesn’t exist, launches a trade war, breaks treaties, discounts the market collapse, confiscates, damages, bullies, and “gets” things wrong? Then there’s his poor judgment and recklessness. CNBC market expert Jim Cramer said bluntly that there are no excuses for perpetrating such capitalist carnage. “It should not be in our country’s interest to have our market crashed.”

Trump’s tariffs aim to spark negotiations and to give America permanent leverage over future tariffs and trade. They were set at high rates to leave room for bargaining: If a country reduces its tariffs, or agrees to economic or geopolitical concessions, tariffs against it will be reduced or eliminated. China immediately called this “blackmail”, which it is. But Trump billed this as revenge for injustices and promised Americans a bonanza, both of which were wrong. In the Rose Garden, he predicted that “the markets are going to boom. The stock is going to boom, the country is going to boom, and the rest of the world wants to see if there is any way they can make a deal. But now it's our turn to prosper, and in so doing, use trillions and trillions of dollars to reduce our taxes and pay down our national debt, and it'll all happen very quickly."

But China isn’t playing his game. Australia’s Prime Minister Anthony Albanese criticized the concept, but won’t retaliate and “join a race to the bottom that leads to higher prices and slower growth.” However, Vietnam capitulated because it is dependent on apparel exports to the United States. Its leader called Trump and responded to America’s 46% tariff on its country by agreeing to lower its country’s tariffs to zero on all American imports. The shares of Nike Inc. immediately recovered after the announcement, after a 15% drop in response to the tariffs. The manufacturer exports most of its products from Vietnam, which are made in factories that employ half a million Vietnamese.

This represented a negotiating victory for Trump, and Ackman (heavily invested in Nike Inc.) posted advice early yesterday to other nations on X: “Call the President. My advice to foreign leaders is that if you have not already reached out to the President, you need to do so immediately. Trump is, at his core, a dealmaker who sees the world as a series of transactions. I expect Trump will reward the early dealmakers with fairer deals than those that wait to sit down at the negotiating table. Countries that respond with additional tariffs on our goods will be severely punished.”

Shortly afterward, Trump’s son reinforced Ackman’s advice:

However, Trump’s little “victory” concerning Vietnam was obliterated the day, on April 4, when markets collapsed after China’s announcement that it would retaliate with 34% tariffs on all American imports, would ban many American products, and would restrict the export of critical minerals and other materials to American buyers. Trump rebuked Beijing for this action and posted on Truth Social, “China played it wrong, they panicked – the one thing they cannot afford to do!”

Obviously, the phone in the White House rang all day as dozens of leaders lined up to negotiate. But significant political pushback grows in America. Anti-Trump protests proliferate across the United States, and the public, Wall Street, Silicon Valley, and Republicans are fuming. Even Trump’s former vice-president, Mike Pence, dubbed the tariffs “the largest peacetime tax hike in US history” — and he’s right. Trump’s across-the-board tariffs of 10% on everything imported are essentially the first national “sales tax” in American history and should technically only be approved by Congress.

There is also open rebellion. Democratic Presidential hopeful Gavin Newsom, the Governor of California, announced he is negotiating “side deals” with America’s trading partners to exclude California-made products, manufactured items, services, and agricultural commodities from their tariffs. The state is the world’s fifth-largest economy and a trading giant with $675 billion in two-way trade with the world. A White House spokesman responded to this by shooting back: “Gavin Newsom should focus on out-of-control homelessness, crime, regulations, and unaffordability in California instead of trying his hand at international dealmaking.”

Despite opposition and growing anxiety, Trump played it cool and spent the weekend at a local golf tournament. As for the tariffs, he remarked, “I think it’s going very well,” when it isn’t. Across the United States, there is fear around kitchen tables and in boardrooms or barrooms. Layoffs in auto factories have begun, triggered by auto tariffs, and people receive margin calls. The media is full of commentators predicting a possible” recession” unless the regime relents or tariffs are quickly resolved. In response, Trump’s Treasury Secretary Scott Bessent, a former hedge fund manager, dismissed financial fears and said, “There doesn’t have to be a recession. Who knows how the market is going to react in a day, in a week? We’re building the long term.”

But Trump’s latest group of fanboys — Silicon Valley — are panicking because of stock collapses and potential retaliatory measures. Tech giants have been running a $705 billion surplus in their “trade” in services globally by selling streaming, cloud storage, and digital products. This is equivalent to the total exports of France, and the technology companies know they will be targeted by the European Union and hit with retaliatory tariffs. This is why they trekked to Mar-a-Lago, and Elon Musk openly criticized the tariffs and their creator, economist Peter Navarro. Musk wants tariff-free trade between the US and Europe, little wonder because his stocks in companies from Tesla to X have dropped by an estimated $11 billion. He attacks Navarro – not Trump – and mocked him as an egghead academic, saying “he ain’t built s@&t.”

As markets melt, the only “good” news is that Trump’s market mayhem will end if he backs off or negotiates better deals. The “bad” news is that he likely won’t, which means the market rout will continue, and the economic future will remain as chaotic as the Presidency. “I think the reason you see so much market turmoil is precisely because businesses don’t know what tariffs are going to be an hour from now,” said a trader.

Trump plays with fire as he always has done. It worked in Queens and on the campaign trail. If only he had heeded Buffett’s advice in March against tariffs. But now he fools around with the world’s financial system, which he doesn’t understand, and this terrifies his biggest backers and the experts: “Our only real hope is that the President comes up with something that can turn this bear into a bull,” commented Jim Cramer.

There is only ONE solution - & I know the world agrees - REMOVE TRUMP - he alone has destroyed the 'good' that USA represents maybe for decades. IF that is NOT enough for the yellow-back Republicans to join forces with the Dems & get him the hell out - they get what they deserve. NO ONE can save USA now - only Repubs uniting & getting that felon OUT OF the White House will stop the carnage.

Mad is an understatement, thank you for the excellent summary. I agree, Trump has managed to ruin the reputation of the US which will take decades to recover, if at all, because he has weaponized his insane supporters. The good news, he has awakened Canada and the World that the US is no longer an Ally you can TRUST; unless you negotiate with Trump (for his personal benefit). US politicians need to stand up to Trump along with other countries.

Who could have believed the star (I use the term loosely) of "The Apprentice" could have been given so much power and influence over the World?