Russia’s war has mobilized the West. Military equipment floods Ukraine, draconian sanctions crater Putin’s economy, and U.S. Treasury Secretary Janet Yellen yesterday warned China against remaining neutral. Hers was a shot heard ‘round the world: Not only has Russia’s invasion redrawn the world’s political map but the economic war of sanctions has accelerated the economic de-globalization that began with the pandemic. The war interrupts the flow of goods and services, changing the world’s multilateral trade system. These realities will be dealt with at an upcoming summit next week in Washington of world finance ministers plus institutions, such as the IMF or World Bank. Some speculate that a bipolar system (the US versus China) may evolve or new trade alliances may form based on political affinity, security requirements, and currencies. One expert suggested that “a great unwinding” is underway while another stated that the world moves “back to the Dark Ages”.

De-globalization began after COVID-19 disrupted economies and supply chains. New suppliers were sought to avoid shortages of food and energy or to protect national security. The pandemic has also caused inflation as governments printed gobs more money to support businesses and workers damaged as a result of lockdowns. And now the war affects inflation and commodity prices such as food and energy because Russia and Ukraine are large suppliers.

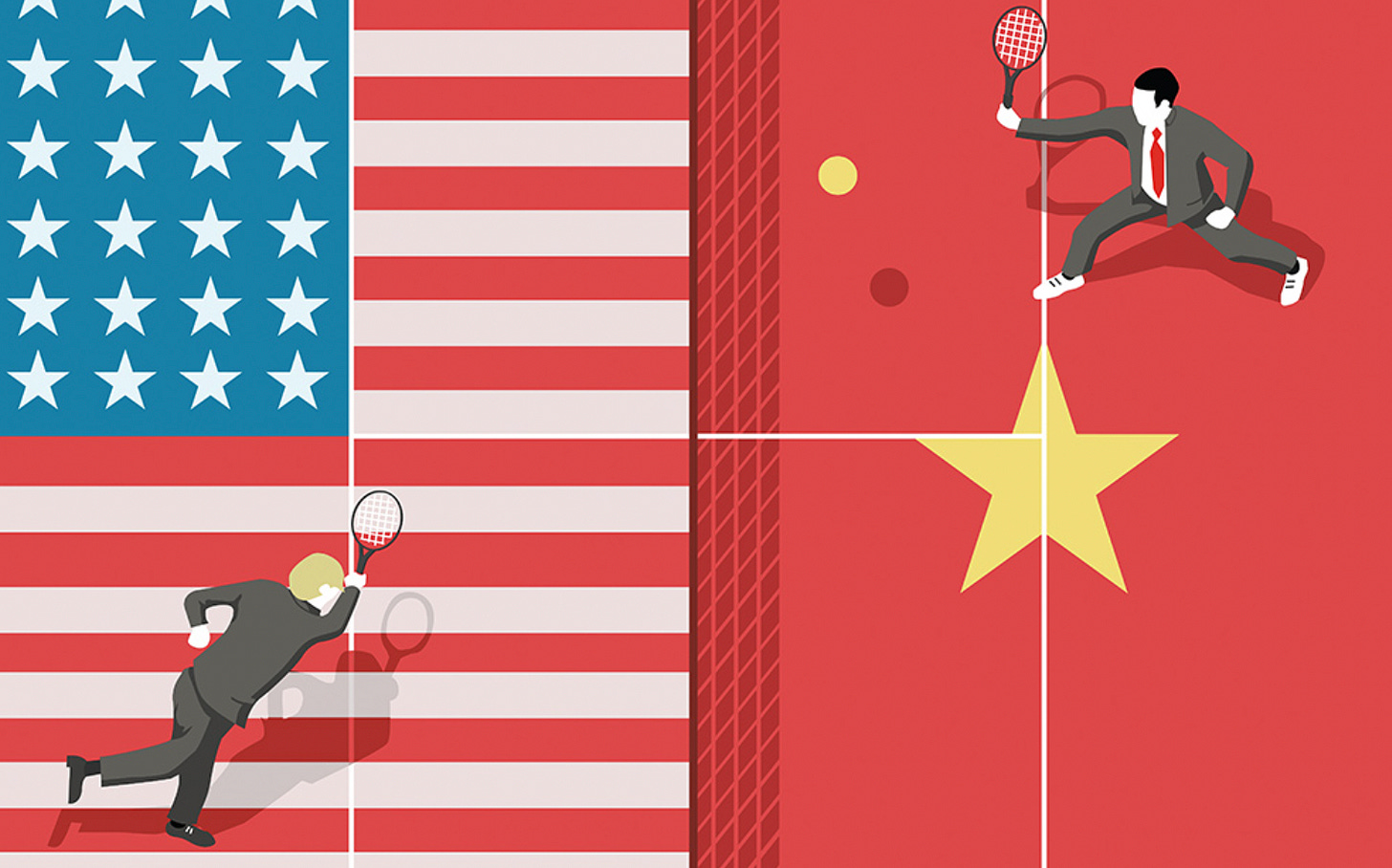

The economic consensus is that if the war drags on for months, global trade will plummet, interest rates will rise and economic growth will slow. The best solution to this fracturing and disruption, suggested one Wall Street Journal reader in jest, would be “to split the global economy into two closed systems that do not cross, interact or trade with one another, like an East-West iron curtain. One based on the US system, one on the Chinese system and let each decide its own path. This would eliminate squabbling.”

While whimsical, research firm Capital Economics took a look at this notion and published its results in the South China Morning News, read by Beijing. Its study found that of the world’s 218 economies, 114 would fall into the U.S. bloc, and 90 into the China bloc. The U.S. bloc would represent 68 percent of global GDP and over half of trade, and the China bloc would include the majority of the world’s population. Of course, the problem with such a “solution” is that the efficiencies of global trade would evaporate and in such a divided world, corporations of all sizes and consumers would pay higher prices for fewer choices.

And the article’s “kicker” aimed at China was: “If the decoupling between the world’s two largest economies were to continue gradually – with supply chains rearranged rather than completely severed – the consequences would be much more disruptive to the China bloc than to the United States bloc,” wrote Capital Economics.

As clouds form over China, Russia’s future is darkness. Putin’s atrocities have fortified global opinion, and America’s sanctions weaponry represents major financial warfare. The Western nations have essentially confiscated Russia's central bank reserves and intend to implode its economy, despite the fact that it is an essential commodity producer of global proportions. For the time being the West has given China a pass, but that may change too. At present, China does not appear wobbly in terms of its support for Russia even though it should do so in order to please its anti-Russia customers and retain its living standards.

The Europeans have joined the Americans in China-bashing. On March 17, French President Emmanuel Macron outlined a new industrial policy for his country aimed at reducing its reliance on China. On March 19, German Finance Minister Christian Lindner stated that China represented an opposed ideology that had become an “enormous risk” to Europe and the rest of the developed world. He went on to be more specific. “Our trade relationship with China is almost a concentration risk for our economy. It may be a trading partner, but it’s also a systemic rival,” he said.

This you-must-pick-a-side mentality will be inflationary because the world depends on cheap Chinese “everything”. China has been the biggest beneficiary of global trade, and its coziness with Vlad has resulted in a massive flight of capital. This was already underway before its controversial collaboration but has sped up recently. And wartime conditions — and alliances — will be front and center at the summit of world financial gurus which will include anti-war sanctions architect Janet Yellen. They will decide how to fix the world’s over-stressed financial and trade architecture.

“I hope we don’t end up with a bipolar system,” said Yellen at an Atlantic Council event on April 13. “We need to work very hard with China to avert such an outcome. The big picture is that China has benefitted enormously from being part of a global system, rules-based, and this has promoted Chinese economic growth. We ought to try to preserve the best features of that system which has also benefitted the US and allies.”

But her warning to China was that it must help to stop Russia’s aggression and that Beijing must not sit on the fence or else it will risk having severe sanctions imposed on its economy by the Western alliance. Besides Russia, China’s problem has been that its state-owned enterprises, and intrusive government edicts, have resulted in practices that have damaged the national security interests of its customers. She said such problems can be overcome within a global economy by “friend shoring”, as opposed to off-shoring. “Friend shoring is about trading with partners we feel comfortable with, can count on, rather than take a domestic [bring jobs back home] approach. This would extend the benefits of continued efficiencies.”

Problems exist beyond the war: U.S. inflation (which began with massive COVID-19 relief allocations by Washington last year), the drop in European consumption due to excessive energy prices, and new lockdowns in China. When interest rates eventually rise, further drops in consumer spending and investments may lead to a recession everywhere. But there will also be winners. Energy inflation caused by the war will hugely benefit energy-producing nations in the Middle East or energy-producing regions in North America to the detriment of energy-impoverished nations. Ironically, U.S. producers will benefit the most, as the world’s biggest oil and gas industry, but American consumers will be disadvantaged.

China, and developing nations, reel from high energy and food prices. China’s growth has fallen to its lowest level in 30 years. “It’s the end of one era and the beginning of another, which is a less complete form of globalization than we had ambitions for in the immediate post-Cold War era,” said Michael Smart, managing director of Rock Creek Global Advisors. “We have to think differently about what we mean by the global trading system. There are certain requirements that, if you don’t meet them, you’re not part of it. You can’t be in the club.”

A ”China Club” isn’t necessarily in the cards either, nor is an invasion of Taiwan, given the world’s reaction to the Ukrainian invasion. China is also running out of resources, its productivity is declining, its economy has been slowing for years, and its population is rapidly aging. Then there’s China’s hideous real estate bubble, which has put the government severely in debt to shore up its banks and hundreds of millions of homeowners. And the pandemic lab secrecy in Wuhan has alienated many nations as has its pact with Russia.

Internally, China has problems as Beijing cracks down severely on its entrepreneurs and most innovative corporations. Its state-owned enterprises have also cheated in terms of accounting practices. The result is that the U.S. intends to more dramatically reduce access to U.S. capital markets for Chinese corporations and they are being gradually booted off its stock exchanges.

Next week it’s likely that the world’s sharp minds, and pencils, who meet to reshape the global economy and trade will end up merely tweaking, not dismantling. However, the caveat clearly is that if China provides Russia with military assistance, all bets are off. Its economy will be in major trouble as customers, investors, and former partners head for the exits.

NOTE: Hit the Share button to send this to social media, but those who wish to email this newsletter to others can do so by forwarding it to another email or, if that doesn’t work, by copying it and pasting it onto another email then sending it in order to avoid the paywall.

Excellent observations Diane, as always !

One of the most powerful tools humans have from which to learn is observation, in context . . .

Galileo, the father of modern science, gave humanity this lesson in spades. When we see the same result from similar events on multiple occasions we can attribute causation . When we observe similar events and results elsewhere, this is the art of scientific discovery.

Those among us who practice 'Observational Technology' are practicing Scientific deduction & discovery . . . in context . . .

Our new world order - Social Egalitarianism, Globalization, Environmentalism and Social Engineering in the 21st Century - The Irony of it all . . .

Printing money to make up for what we gave away in the name of Environmentalism and Globalization, to the Third World and China - Our Economies are dying - Social Elitism has failed - Now the once powerful 'Home-Grown' Unionists ARE the down trodden. Unionization is at it's lowest point since 'collective Bargaining' was legalized 100 years ago. - They payed the price - while the Elitist Socio-Economic Wisdom thrives - in the West - meanwhile China Laughs - All the way to the Bank. China today IS the back bone of Global productivity.

China alone, processes 60% of Global Base Metals, 6% 30 years ago . . . and all the pollution that goes with it - 25 Chinese Cities now account for 50% of Global CO2 - Out of site - Out of mind . . . The New World Order . . . 30 years since China evolved . . .

Western Elitist self-flagellation in the name of Environmentalism - Maintains Total Global Pollution - While stripping away what had been the very life blood of the Western Economies . . . With no end-gain . . . in Global terms . . . Total GLOBAL Pollution remains the same !!!

In 2017, China's GDP growth was 27% . . . today it is struggling to reach 5% . . .

Economic calamity from reduced demand, Russia's War and China's economic decline does NOT bode well for the Global economic system . . . Deflation may be in site . . . ?

Brilliant newsletter. Economic sanctions, boycotts, alliances are all the ingredients for a world war.