Will history repeat? We know it rhymes and there are many parallels between the 20th Century’s Roaring Twenties and the decade underway. Both followed pandemics, the Spanish flu in 1918 and 1919, which killed between 20 million and 100 million people worldwide, and COVID, still underway. Once the end of the scourge was in sight, the American market and economy took off in the 1920s until the 1929 crash, hopefully, an unrepeatable event this time. After all, back then the stock market had no regulatory brakes in place and was nothing more than a casino rigged by insiders.

The economic explosion in the 1920s was mostly due to technological innovation (radio and widespread electrification), boundless optimism, as well as the booming stock market which helped finance new enterprises and more innovation. Income disparity was far worse back then, but things were “swell” for half the country economically as well as psychologically. Similarly today, there is widespread relief that the dreadful pandemic is ending and an economic and technology boom is underway.

The question is, are we at the start of this century’s Roaring Twenties? That’s what the charts and lots of smart people predict.

GDP growth is forecasted to rise, but other key economic indicators are promising such as inflation rates, interest rates, industrial production, consumer confidence, worker productivity, retail sales, and unemployment rates. Interest rates are at an all-time low, thanks to massive government stimulus, and inflation hasn’t reared its ugly head as yet.

America, as things now stand, favorably ticks off all the other boxes. Most significant is the fact that worker productivity has begun to move off the charts – not as a bounce-back phenomenon or a blip but because of an astonishing number of technological advances that are now bringing enormous gains to businesses of all sizes, and individuals, across the board. The US Bureau of Labor Statistics states that this productivity growth – a driver for higher living standards – soars after years of lingering around 1.3 percent annually since 2006. On June 3, the Bureau reported productivity was up by 5.4 percent in the first quarter of this year.

There are several reasons for this upturn. The first is technological: the past decade has delivered an astonishing cluster of technology breakthroughs. The most important ones are in AI: the development of machine learning algorithms combined with price decline for data storage and improvements in computing power that has allowed firms to address challenges from vision and speech to prediction and diagnosis. The fast-growing cloud computing market has made these innovations accessible to smaller firms.

Most importantly, this decade launched a scientific transformation equivalent to the discovery of antibiotics in 1945 – the mRNA Revolution of 2020 which I described in my April 5 newsletter called “Miracle on Mainz”. This scientific sea change will save millions of lives, extend lifespans, improve the quality of life, and harness digital technologies to biology in order to create continuing treatment solutions quickly. Genetic medicine may be a major underpinning for The Roaring Twenties 2.0. Breakthroughs will include vaccines against many cancers, HIV, tuberculosis, rabies, malaria, new influenza, and the next pandemic. This means more productive workforces, longer lives, and lower healthcare and medical costs.

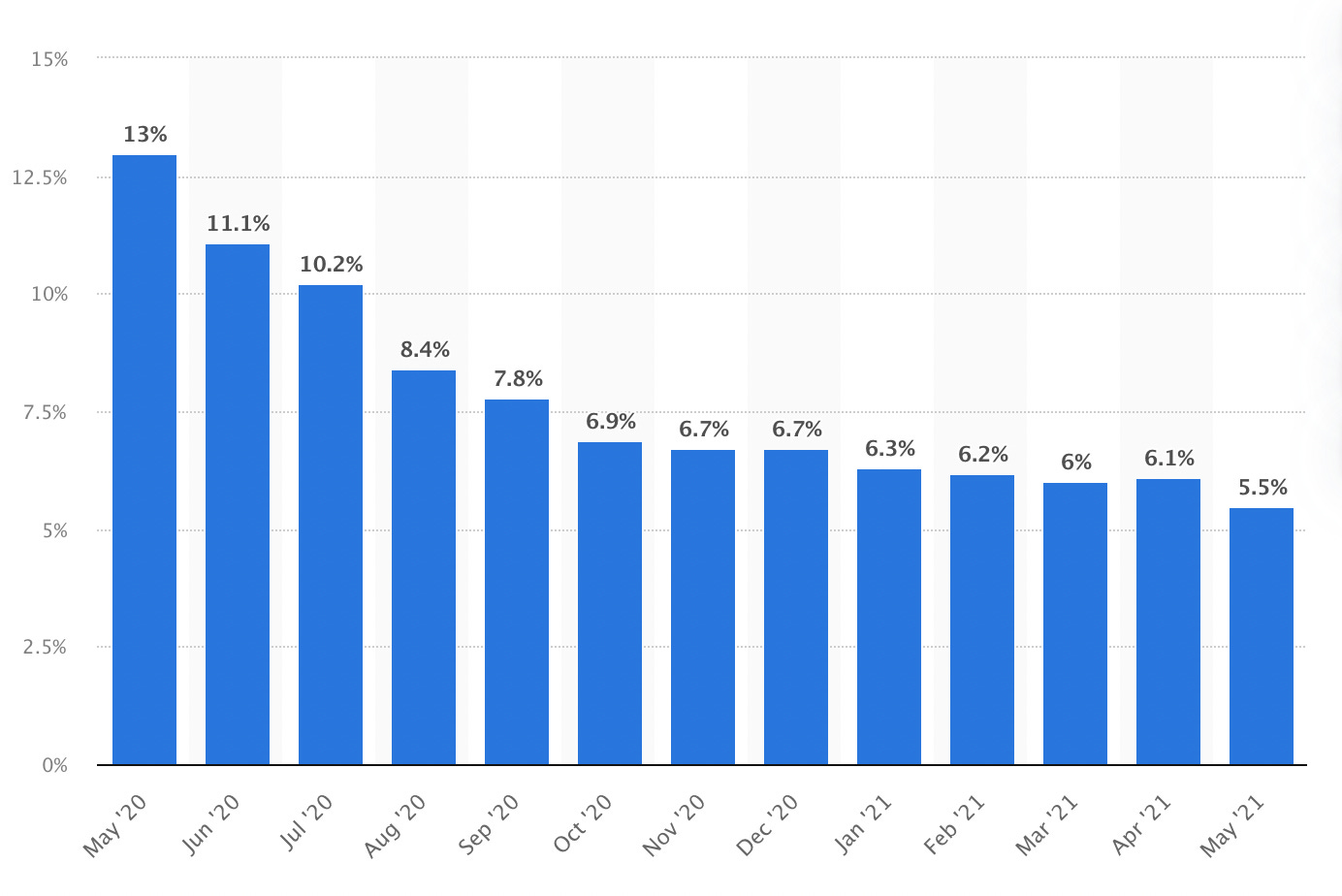

This decade, Americans, unlike other years, also have the wind at their backs in the form of governments willing to spend billions on vaccines and to backstop workers, poor people, and businesses to help them through the pandemic crisis. This has brought down unemployment rates rapidly while also, at the same time, resulted in wage hikes, notably higher minimum wages in most states. Both indicators provide another underpinning for continuing recovery.

As a result of more employment at higher wages, retail sales have begun to climb which, in turn, begets more jobs in the manufacturing, logistical, and commerce sectors. In essence, the American economy is running at full speed. People are spending more, which fuels the virtuous cycle, and they are also feeling better about life and their future prospects.

Another economic positive is that the pandemic compressed trends such as remote work and self-employment. Such digitization and restructuring is and will remain a big contributor to the enhanced productivity curve now underway, according to MIT Technology Review’s “Ten Technology Breakthrough Technologies in 2021”.

With propitious conditions in place, it’s little wonder that some Wall Streeters are talking about a “blowout year” for markets and the economy. Technology is delivering lower prices on goods and services for consumers and also major efficiencies and productivity gains for the economy. And to top it all off, consumer confidence is returning after being clobbered in the past year.

Confidence began to soar in January with a change in government in Washington and bodes well for a rollicking ride going forward. Polls also show that most Americans believe their living standard is improving.

But, as has been demonstrated throughout history, politics eats economics for breakfast. The caveat on all of this is the specter of nagging gridlock in Washington for years or a major geopolitical mishap. But if or until that happens, enjoy the ride.

My newsletters will arrive in your inbox Monday and Thursday mornings

Hate to sound so negative but be wary of the euphoria. World and national debt is at an all time high and inflation is real. Geopolitical tress and tensions are building and somewhat frightening. Like you said, enjoy while you can, dark clouds are on the horizon.

It always takes me back to around 2012 . Banks in the US were offering equity loans, if you house was rated at 800k then it would probably go to 1.2mill hence you can borrow on the house for extras that you might need. A boat , a fast car, a vacation in Monaco, etc. Case in point a top floor penthouse in Fort Myers was valued at 1.2million, the owners bank offered an additional $680k mortgage on the unit enough to buy a boat. Everyone in Fort Myers needs a boat !. The owner took the 680k and was never seen again!. Friends of mine bought out the bank for $180k 6 years ago. The bank lost about $500k . The property is now rated at $650k or not depending who you talk to !