Many of the world’s 180 national, or fiat, currencies are like monopoly money, issued by inept regimes or corrupt ones that crank up their printing presses to create worthless paper in order to buy power. The same applies to 22,000 cryptocurrencies that litter the financial landscape and whose values, including Bitcoin’s, are capricious because they are only digital files whose values veer wildly from transaction to transaction. The “gold standard” of currencies is the US Dollar because it is governed by a politically independent Federal Reserve System that is tasked with protecting monetary value and banks, in order to alleviate financial crises. This reliability, and America’s economic superiority, is why the “greenback” has dominated the world’s financial transactions for decades. But Russia attacks this monetary superiority and hopes to convince China and others to topple the Dollar’s dominance. This won’t work anytime soon, if ever because “you can’t replace something with nothing,” commented economist Nouriel Roubini.

Even so, Vladimir Putin boasted after his recent meeting with China’s Xi Jinping who won’t back his war, that “we are in favor of using the Chinese Yuan for settlements between Russia and the countries of Asia, Africa, and Latin America.” A Russian official added that Moscow will propose the creation of a new currency at the upcoming BRICS (Brazil, Russia, India, China, and South Africa) summit in Durban this August. This new currency, he said, will be pegged to gold but also to “other groups of products such as rare-earth minerals or soil” — a strange proposition which reveals Russia’s complete ignorance as to how the system works. Russia believes that the US Dollar’s financial hegemony is a conspiracy that can be undercut when, in reality, it’s a time-tested system that prevents American politicians from deflating or inflating the Dollar’s value or reneging on their commitments to the world’s US Dollar bond holders and US dollar depositors.

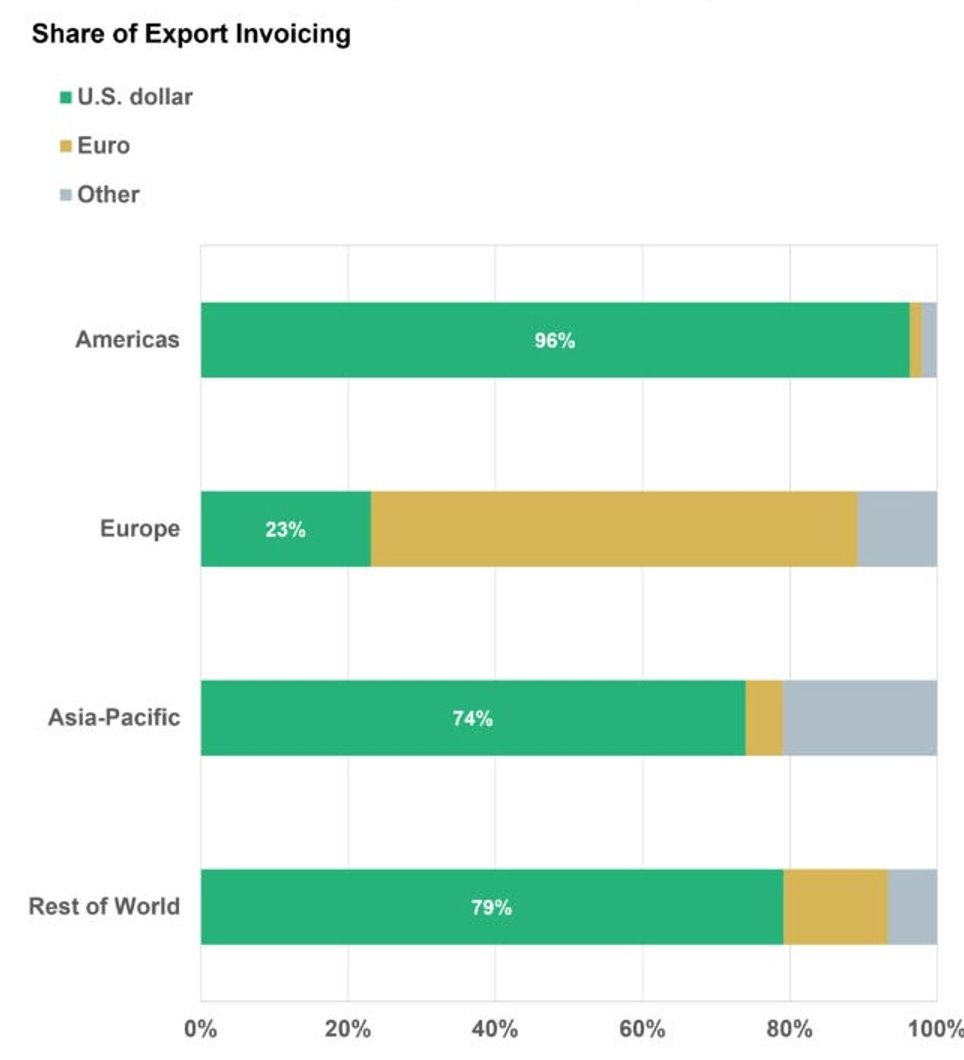

The “greenback” is stable, internationally available, and acceptable to everyone from sovereign nations to street vendors. Its closest “competitor” is the Euro which was created in 1999 to replace local currencies and facilitate trade within Europe and with the rest of the world. It improved the continent’s economic stability and growth, helped integrate its economies, and made its markets more efficient. China is expanding the reach of its Yuan through bilateral or trade deals. Brazil has agreed to two-way trade in Yuan; Beijing is mostly paying Yuan, not US Dollars, to Russia for energy and soon Saudi Arabia and other oil producers may do so. But these proceeds are usually converted into Dollars or Euros for safekeeping, except by Russia which is shut out of the system by sanctions.

China’s Yuan may be increasingly used to settle trade transactions but won’t become a global medium of exchange until it creates an independent reserve banking system that is free from political interference and backed by an economy underpinned by capital markets (stocks and bonds) that are transparent and globally recognized. Beijing’s central planning is politicized, and its macro-economic metrics are not trusted – from its professed GDP figures to statistics like Covid deaths, debt estimates or earnings per share of major companies. Worse, it does not recognize private property rights and Beijing’s recent political interventions and confiscations involving home-grown tech and financial conglomerates have permanently turned off long-term investors.

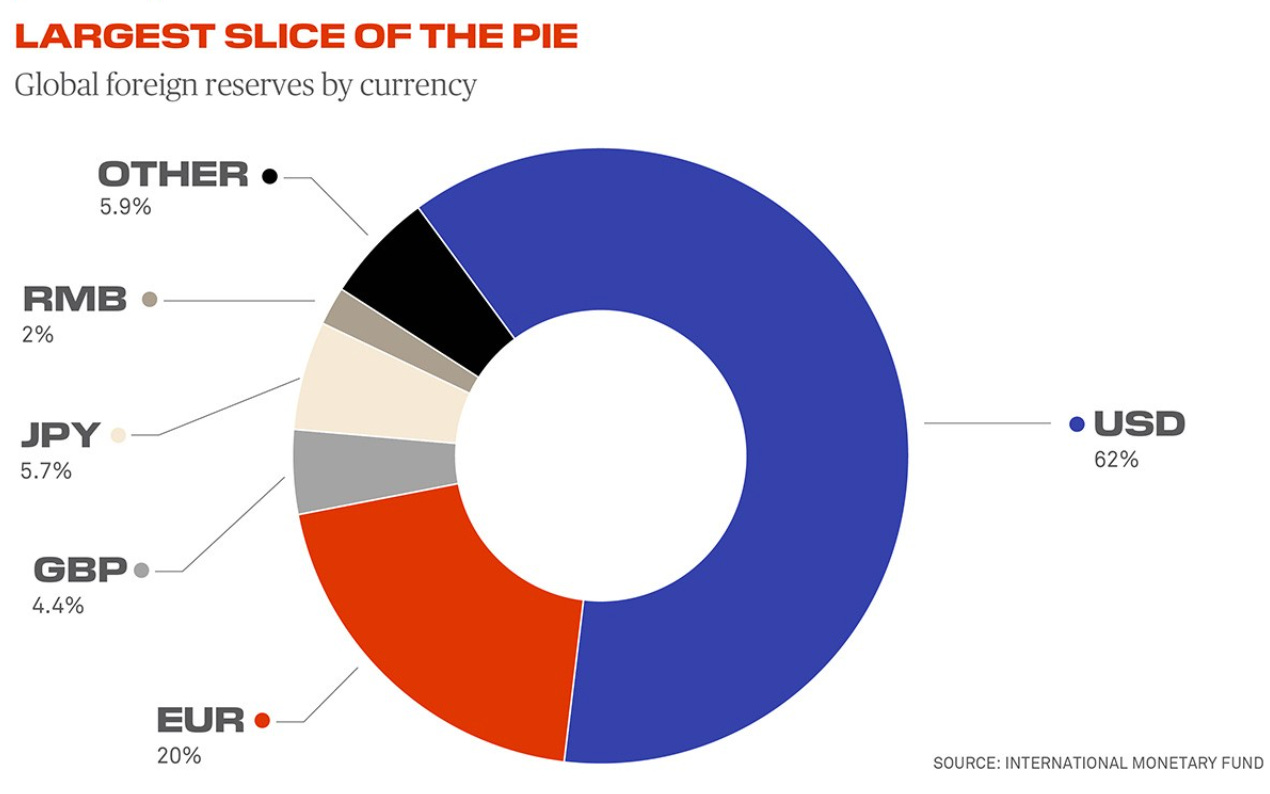

“The US has the world's deepest and most liquid financial markets thanks to the following: The size of the US economy, the strength of the US economy, open trade and capital flows, with fewer restrictions than a lot of other countries, and strong rule of law and property rights, with a history of enforcing them," explained an economist. “This is why, despite the US making up just about 25 percent of the world economy, about 60 percent of global foreign currency reserves are denominated in US Dollars.”

But the “de-dollarization” cause resonates politically around the world after Washington weaponized the financial system by cutting off Russia completely, imposing draconian sanctions, and freezing Russia’s $300 billion in dollar or other foreign exchange assets in central banks around the world. “This has damaged the US Dollar’s credibility the most, making it an increasingly high-risk asset,” argued a Chinese economist. “What if we are targeted as a rival?”

Ironically, Russia’s anti-Dollar drumbeat will backfire. The international expansion of the Yuan is not, and won’t, hurt the US Dollar because it will require China to increase its dollar reserves as a stabilizing backstop, primarily in Hong Kong. The two currencies will complement one another, as is now the case between the US Dollar and the Euro. More significantly, most of Russia’s revenues are now in Yuan which makes it more dependent on China than ever, an unsettling situation. After all, the two have fought wars before over territory, and after the Ukraine war, a weakened and European-centric Russia may not be able to keep control over the 77 percent of its land mass which is Asian.

The only real threat to the hegemony of the Yankee Dollar is inside America. The currency is strong because the Federal Reserve System “keeps a steady hand on the tiller”. Its responsibility is to insure “the full faith and credit of the U.S. government” so that the dollar’s value is protected, banks are safe, and the payment of principal and interest on U.S. debt instruments is guaranteed without risk of default. This discipline provides two huge benefits to America: It can borrow as much money as it wants and its iron-clad guarantee means holders are satisfied with relatively low interest rates in return for safety. But the wild card is its democracy.

America has a federal law that imposes caps on the amount of money the U.S. Department of Treasury can borrow. Any increase must be approved by Congress. The debt ceiling is raised routinely, and there’s often controversy about this, but the caps have prevented runaway spending and a collapse in value. However, de-dollarization supporters try to exploit each debt ceiling debate or bank failure. Last month, the pro-China Asia Times published a headline that the “US bank trouble heralds end of dollar reserve system”. Writer David Goldman wrote: “The US bank system is broken. And the geopolitical consequences will be enormous. The seize-up of dollar credit will accelerate the shift to a multipolar reserve system, with advantage to China’s RMB as a competitor to the dollar.”

There is competition already and the share of US Dollars in central banks has dropped to 60 percent from 70 percent in 20 years mostly because of the Euro. The Yuan will grow in importance and digital currencies are also on the horizon. But there will be no wholesale shift to any currencies until they are backed by dynamic economies with military power and monetary discipline. Even among those currently in contention, former U.S. Treasury Secretary Lawrence Summers dryly described why they won’t dominate. “Europe is a museum, Japan is a nursing home, and China is a jail.”

seems another sure bet that the House GOP does or should know this but will risk the worlds economy by not raising the debt ceiling. They would do this not because of any stated reason but simply to feel powerful.

VERY informative - tks Diane - knowing the safety of the American standard dollar IS important