The Great Russian Recession looms as Putin intends to cripple Germany, Europe’s engine of economic growth and Russia’s biggest energy addict, by stopping the flow of natural gas soon. This is his best weapon of mass destruction, along with food blockades, because both trigger inflation, the “slayer” of economies. Prices are so high that the ripple effect of inflation, economically and politically, is more devastating than are the West’s sanctions against Russia. The closure of hundreds of McDonald’s restaurants or the cratering of banks and the Ruble damage economically but not politically. Putin’s 141 million people have been thoroughly brainwashed and politically enslaved for decades. They won’t revolt. But others might.

As the map above shows, the annual inflation rate in the first quarter of 2022 is twice as high as it was in 2020 for 37 of the 38 members of the wealthy Organization for Economic Cooperation and Development (OECD) as well as for seven other economically significant countries. Europe is hit hard, but America, blessed with enormous resources and the lowest dependency on trade of developed nations, is afflicted less. However, stock markets everywhere have fallen, as have most currencies especially the Euro “because Europe has no energy”, according to one expert. Turkey, for instance, has the highest inflation rate in the world at 54.8 percent — due to high energy and food prices but also to punishing monetary policies. To some, a recession is already underway.

The biggest victim will be wealthy Germany, the country that caused the Ukraine war in the first place by relying heavily for energy on the predatory Putin, thus undermining its economy and all of Europe’s at the same time. Post-war Berlin prided itself on building what it believed to be the world’s most successful economic model, military pacifism, and a pristine environment. But the flaw was that its popular former Chancellor, Angela Merkel, forged an inexplicable bond with Vladimir Putin and handed him an energy franchise that everyone warned would undermine Europe’s security. We all know how that turned out.

On February 24, Putin brutally invaded Ukraine and held Europe hostage. Now Germany has had to reverse course by burning coal again, doubling military expenditures, and joining America and NATO in the effort to ship lethal weapons to Kyiv in the hopes it can defeat Putin’s army.

But if the war continues, this winter Germans and Europeans will freeze in the dark or must ration and find fresh supplies from the Middle East, U.S. or other sources. Unfortunately, there’s not enough oil and liquified natural gas to go around. It takes years to build pipelines and facilities so bring more to market so Europeans now compete feverishly for natural gas, thus driving prices up further, by 700 percent, and inflation rates with it.

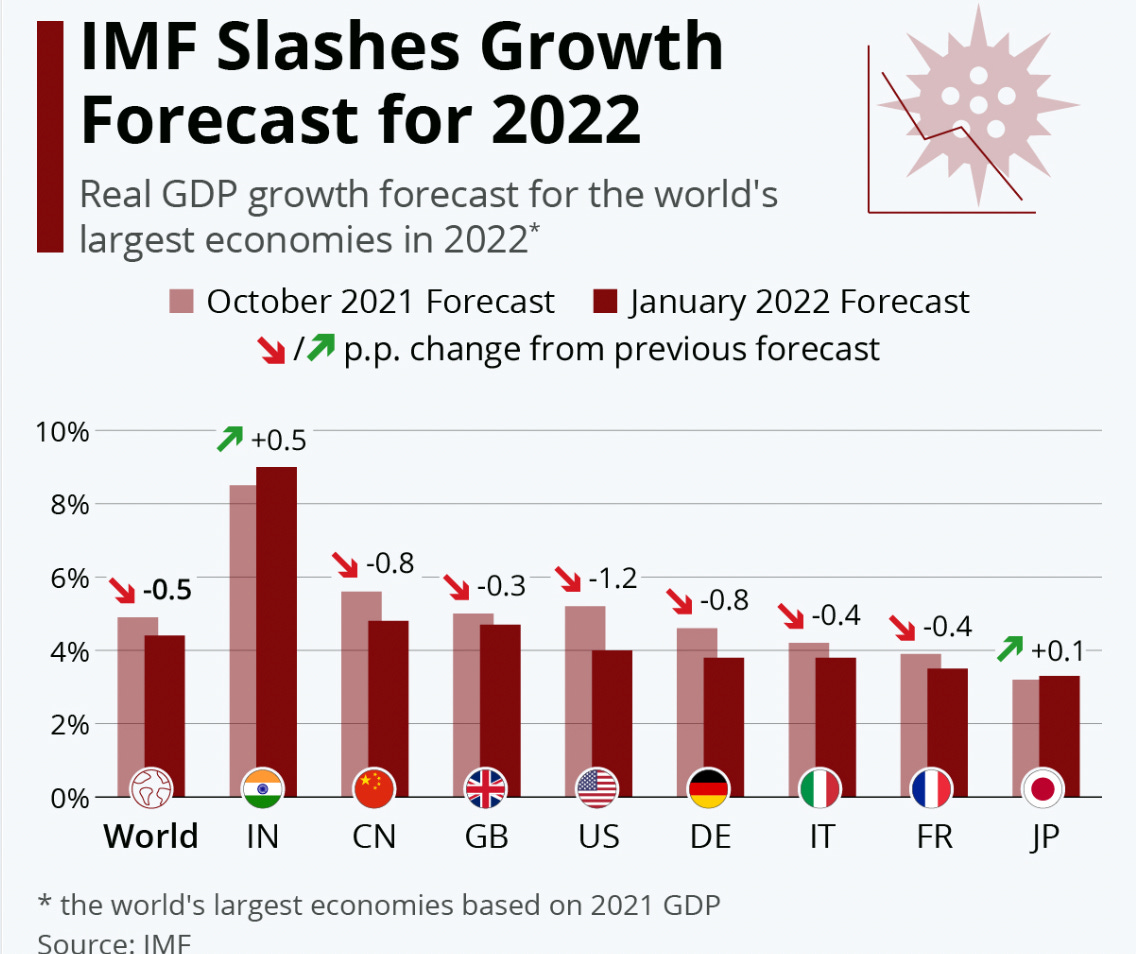

This crisis has forced the world’s economists to sharpen their pencils. The World Bank just halved projected global growth rates for the next 12 months from last year’s level. “For many countries, recession will be hard to avoid,” said its President. The OECD slashed its outlook for global growth and doubled inflation projections, warning that the fallout from war could worsen with long-term damage to supply chains.

Economist Nouriel Roubini writes this week that a “synchronized global recession” is probable, the bear market will go down further and that “bubbles are deflating everywhere – including in public and private equity, real estate, housing, meme stocks, crypto, SPACs (special-purpose acquisition companies), bonds, and credit instruments. Real and financial wealth is falling, and debts and debt-servicing ratios are rising.”

Overall, the United States is least affected because it is the world’s energy and agricultural powerhouse. In fact, inflated prices benefit these important sectors and both inflation rates, and unemployment rates, are lower in the U.S. than in other large economies, despite slowing output. This odd economic outcome has been described as more of a “job-full” downturn rather than a traditional recession. Even so, former U.S. Treasury Secretary Larry Summers believes an American recession will start this year, not in 2023 as he predicted before the invasion of Ukraine.

Politically, Biden has tried to deflect the inflationary role played by government overspending and claimed inflation is due to “Russia, Russia, Russia” with some validity. Germany’s Chancellor Olaf Scholz is shuttling to countries in the Middle East to obtain energy and even trekking to Ottawa in hopes of convincing Greta Thunberg’s favourite photo-op partner, Canadian Prime Minister Justin Trudeau, to drop his climate zealotry. Germany will be offering tens of billions to transport gas thousands of miles from Canada’s west to German-financed liquefied natural gas projects to be built on Canada’s east coast. Don’t bet on Canada’s lightweight regime embarking on a sensible industrial strategy even if the Germans bankroll it.

Hope still remains that Ukrainians may be able to turn the tide in coming months if the flood of NATO weaponry makes a difference and if sanctions prevent Russia from replenishing its armaments. Some Putin critics believe the war will lead to a depression in Russia and contraction of its GDP by 25 percent next year. Whatever happens, legendary investor and philanthropist George Soros believes that Putin must be removed or “civilization won’t survive”. “I think Ukraine today is rendering a tremendous service to Europe and to the western world and to open society and our survival because they are fighting our fight. They have a really good chance of winning...[W]e must give them all the support that they ask for."

But Putin bombs Ukraine and has detonated an inflation bomb everywhere else. Every nation is now suffering which changes the political calculus globally. As former U.S. Ambassador to Ukraine Steven Pifer recently put it: "The bigger issue is going to be whether there's the political will in Europe and the U.S. to continue the fight. So far, I think it's there. Whether it can be sustained six months or 12 months down the road, I don't know."

NOTE: Hit the Share button to send this to social media, but those who wish to email this newsletter to others can do so by forwarding it to another email or, if that doesn’t work, by copying it and pasting it onto another email then sending it in order to avoid the paywall.

Good as far as it goes but lets not forget the Left in the US and Canadian commitment to shut down the fossil fuel industry. That sent fuel prices rocketing well before the Russian invasion.

Great reporting again. I believe PM Justin Trudeau MUST change his commitment towards Climate Change. World wide, oil and gas is required in so many ways, we must continue to exploit our resources in a climate friendly manner. Our economy needs that industry and we must promote LNG projects. Canada should not be importing any oil and gas from foreign countries. If Provinces choose to do so, then tax their imported oil and gas accordingly.