An African proverb pertains to the US-Canada trade battle: “When elephants fight, it is the grass that suffers.” Trump’s war with China is shaking up the world and will do so for some time. Beijing has hit back, and now the world waits to see who blinks first. Trump backed off somewhat on April 9, following market chaos, and paused his “reciprocal” tariffs for three months. But when these eventually unfold, global trade will contract and restructure dramatically. Until then, markets continue to roil, trade shows are canceled or postponed, and intermediaries scramble to find workarounds or to make a deal with the testy Trump. Profits evaporate, supply chains wither, and China fights back by redirecting products destined for the US to other countries to avoid America’s 145% tariffs. But Beijing and others may also decide to dump all of their massive US Treasury holdings, which could send US mortgage rates skyrocketing and lead to inflation and a recession. While some experts believe it is unlikely, China's President Xi Jinping has dug in and publicly promised to "fight to the end.”

So the question is which “elephant” is going to win? Trump said on April 17 he expects an agreement "over the next three to four weeks” but most observers are skeptical. Trump thinks he has more cards than China, but he’s wrong. President Xi Jinping is one of America’s biggest lenders, holding a stash of US Treasury bills, but is also a formidable foe with trade clout and a global network of allies. He will also capitalize on the reality that Trump’s antics have made many realize that China is a better alternative to deal with than an erratic, fickle, and inconsistent Washington. Most importantly, however, he runs a powerful autocracy that controls China’s people while Americans are unsettled and openly angry about all this tariff fuss, collapsing stock markets, and looming inflation.

China has retaliated with high tariffs on American goods. It halted delivery of a fleet of Boeing aircraft. Deliveries of American LNG have also ended due to tariffs of 49%, which threaten the completion of several multibillion-dollar LNG terminals in Mexico and the US. Another important constituency and export sector, US agriculture, is upset that Washington imposes fees on Chinese-built ships that transport US grain and other agricultural commodities. Beijing has expanded export restrictions to seven rare earth elements and magnets in early April, which may soon lead to disruptions in the automotive, tech, and aviation industries in the US and worldwide.

America will also suffer as some partners and customers pivot toward China to tap its gigantic market and workforce. Spain just announced plans to increase relations with China despite a threat from Washington officials that that would be like “cutting your own throat”. President Emmanuel Macron of France urged European companies to stop investing in the United States. The European Union is sending a delegation to Beijing this summer and plans to retaliate against the U.S. with tariffs and possibly higher taxes on U.S. tech companies. Britain, no longer a member of the EU, is moving toward re-integrating with the European continent and making trade deals with other middle powers.

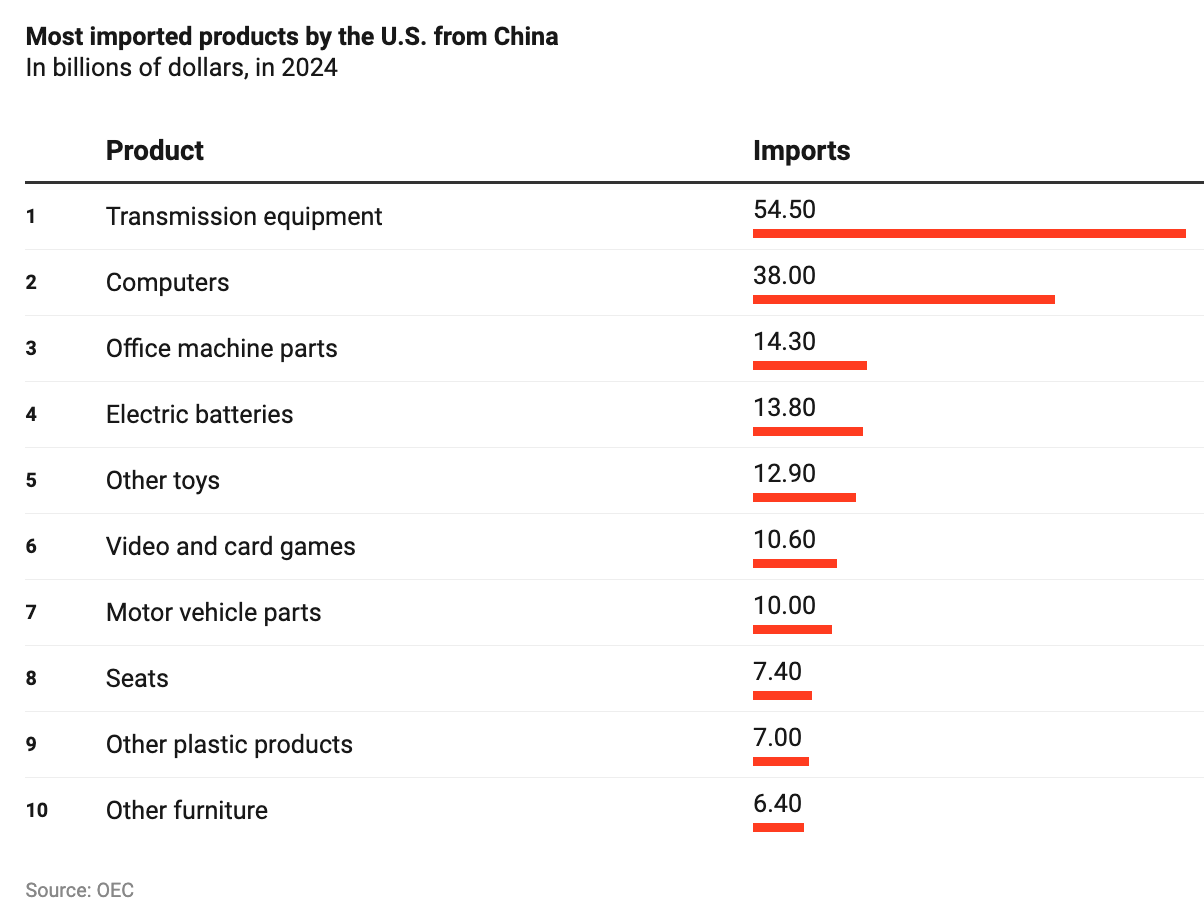

Another “trump” card for China is that what it imports from the United States (mostly agricultural products and commodities) is easily replaceable elsewhere while American imports from China are not. This means the risk of a lengthy, knock-down-drag-out war with China is greater for the United States. “US dependence on China is higher, because China can source agricultural products from elsewhere more easily than the US can replace electronics and machinery,” said Marta Bengoa at City University of New York. “Beijing is already buying up soyabeans from Brazil, for example, so in the end China has a bit more leverage”.

American consumers are not amused about a trade war with China, and neither are its companies and retailers. Most are concerned about the inflationary effects of tariffs, and many retailers will be unable to pass the cost along to their customers. Wall Street is also upset with Trump’s recklessness and seeming indifference to protecting capital markets, as well as his recent hint that the head of the Federal Reserve should step down because he hasn’t lowered interest rates. Shudders swept through markets at the thought that Trump would attack the Fed and fire its Chairman because both underpin the value and influence of the US currency worldwide.

American technologists are not happy either. Silicon Valley is deeply embedded in China with large-scale manufacturing operations and a growing consumer market. Trump ally, Elon Musk, has been outspoken and called Trump’s tariff guru, Peter Navarro, a “moron”. The two will likely fall out over this issue due to Musk’s business investments in China. So will others. A steady stream of important American entrepreneurs and organizations have trekked to China since “Liberation Day”. Most notably, Nvidia CEO Jensen Huang went to Beijing after Trump suddenly blocked the export of his company’s H20 chip, designed to meet previous American restrictions.

The ban against Nvidia was sudden and more significant than just the fact that it damaged the bottom line of America’s top rising star in the semiconductor chip world. The blockage illustrates how unreliable Trump's trade policy is, a given nowadays that is forcing businesses to try and do business with both superpowers. The Financial Times reinforced why the tech world has had to plant itself in both economies: “The tech sector’s concern is that the effort to force greater onshoring of the chip and electronics manufacturing will have the unintended effect of holding back the likes of OpenAI, Google and Microsoft which are seeking to beat counterparts in China in building advanced AI.”

Trump declared this war because China, and others, have out-performed the United States in terms of productivity and service, and also because Beijing has stolen intellectual property and cheated along the way. But Trump’s tariffs now upend everything from global capital flows to supply chains and technological development. Last week, America’s weaker position became apparent due to decades of overspending and increasing dependence on lenders, including China and the other Asian tigers. These successful trading nations, as a result of hard work and thrift, have accumulated trillions of dollars that are invested in US Treasury Bonds. On April 9, one week after the tariffs were first announced, the regular, global U.S. 10-year bond market auction failed and the Trump team panicked. They convinced him to announce the 90-day tariff pause or face a financial meltdown. What happened is a mystery, but it’s a good guess that China and Japan dumped hundreds of billions of dollars in US bonds that day to send a message, and will do so again.

So who’s going to win? Nobody. Who’s going to lose? Everyone will lose, both the “grass” and the “elephants”.

All true, Diane. But there is one other factor at work. China's response to Trump appears to be measured and sensible, while Trump's governance appears simply...........

Makes one wonder which of the two presidents is the apprentice.

Some of these trade imbalances as well as the rickety financial constructs lurking in the background--especially the expanding debt stemming in large part from the massive tax breaks for the wealthy and corporations passed by the previous Trump administration and pending renewal by this one, have been obvious to many financial experts for at least the past several years, but, like those credit card holders who run up huge balances, ignoring the true cost of the fees involved, prioritizing immediate gratification over long-term solvency and thereby risking big problems down the road, we've looked the other way. So what are we to do? Take it on the chin, I guess, but we'd better be making our anger at this rolling betrayal plain as day and DEMANDING REFORM.